The key to building a working SEO strategy today is not to use generic principles. SEO is the domain that is very sensitive to specifics. That is why SEO tactics for direct-to-customer small retail businesses will drastically differ from SEO tactics larger tech companies will use. SEO could be quite different depending on your geolocation and geographical market peculiarities. Insurance is no exception. It has its own specifics that affect how well certain SEO instruments and tactics perform. In this article, we will get down to the bottom of what is successful SEO if you are an insurance agency or broker.

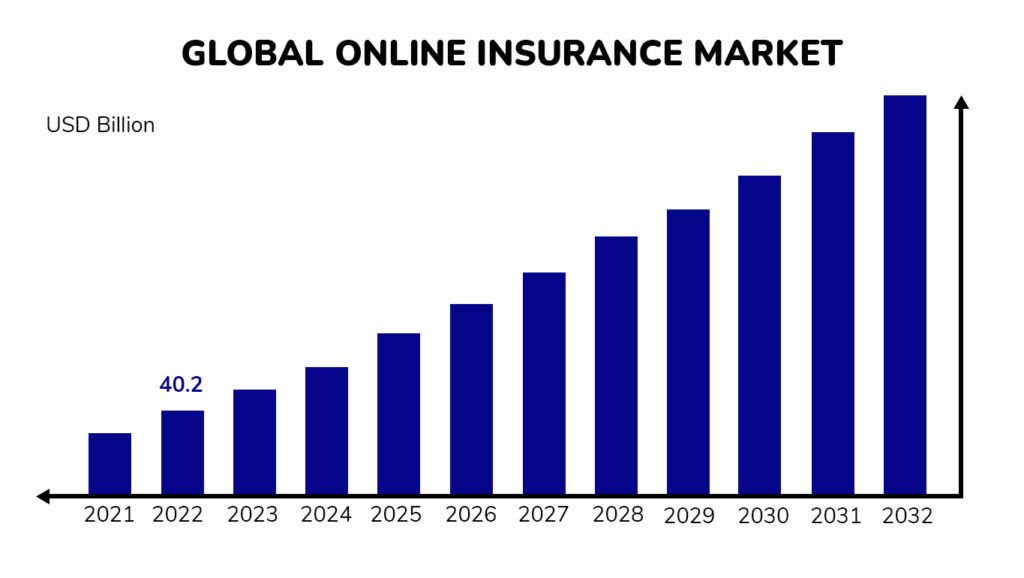

Global online insurance market is on the rise, so the stakes placed on SEO are getting higher as well.

Let’s look into various aspects of SEO and their key points in relation to insurance.

Technical SEO for Insurance Companies

Insurance is always associated with reliability and stability. It would look strange if you sold services that foster these values through a website that doesn’t work stable or performs well.

Technical SEO refers to all the processes associated with improving your website’s technical performance. It is common knowledge that it is one of the things search engines look at when they calculate SERP rankings for a page. Pay extra attention to the following:

- Site Speed Optimization

Your website should be quick to load. You can improve the loading speed by compressing images, enabling browser caching, and minimizing HTTP requests.

- Secure Socket Layer (SSL)

The use of secure HTTPS is one of the ranking factors Google uses in SERP calculations. Consider implementing it if you want to improve your SERP results.

- Structure your Data

You can help search engines to parse your website and increase your chances of being selected for featuring in Google rich snippets. Use schema markup to help search engines understand your content and address specific FAQs in it. It will increase your chance to get picked for featured snippets, which can greatly improve your visibility.

- Use XML SiteMaps

It is a great tool to allow search engines to crawl and index your website faster.

Page Loading Time and Mobile Compatibility

In 2024, over 60% of global Internet traffic is coming from mobile devices. Insurance business demonstrates similar tendencies. More often than not, people use their phones to quickly look up insurance companies or compare prices on the go or access their websites in case of an emergency. This means that it is absolutely essential to make your website and resources 100% mobile-friendly. These best practices will help with that:

- Implement Responsive Design

Your website needs to be built in a way that allows it to seamlessly adapt to different screen sizes and device specifics.

- Use Accelerated Mobile Pages (AMP)

Use AMP technology to create fast-loading mobile pages. This can help you rank higher in mobile search rankings.

- Improve Mobile Usability

You can use Google’s free Mobile-Friendly Test tool to define whatever mobile-related issues your website may have. If you have any problems on mobile with things like font sizes, touch elements, and viewport settings, and they hinder the user experience your website offers, you will find them and fix them.

Work with Meta Tags

Meta tags play a very important role for on-page SEO and how search engines and users perceive your website. If as an insurance company or broker, you have any specific perks or distinguishing features which you wish to market, mention them in your meta tags. This way, users who are looking for this type of insurance specifics will have a much better chance of finding you.

- Title Tags

Your title tags need to be compelling and descriptive and need to incorporate important keywords. Imagine that you’re only given several words to fit the most important things your insurance business is about. That is what your title tags should be.

- Meta Descriptions

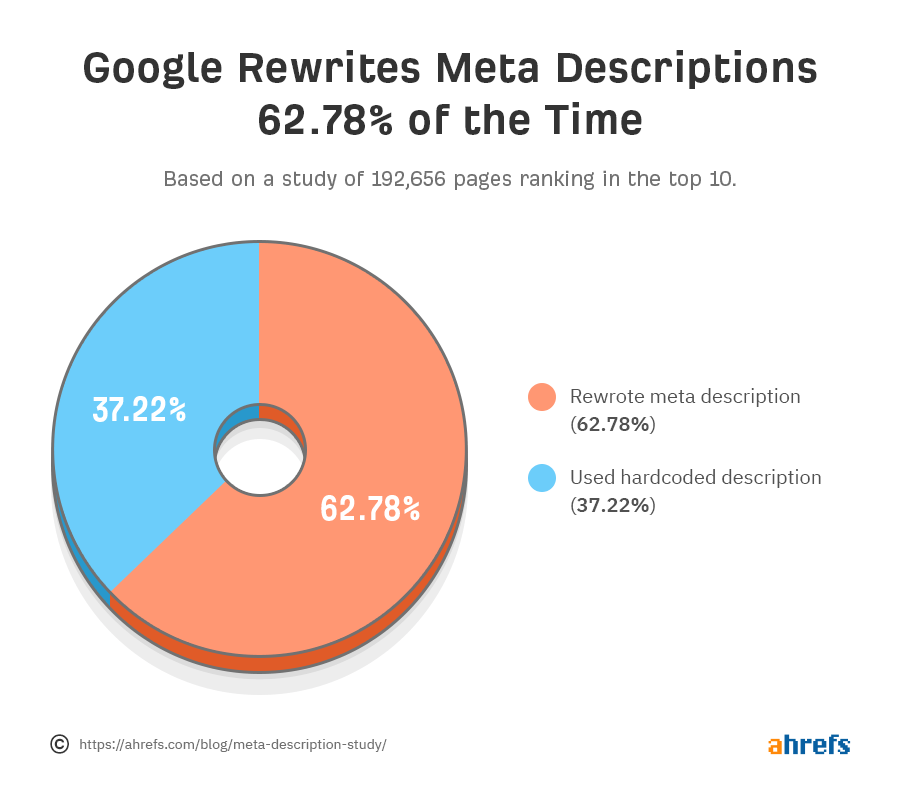

When users are looking for something, Google presents them with a wide choice and gives a brief summary of what they will find in this or that site. This summary is a meta description and you can influence what your users see. It has to answer to their query precisely and offer something that will make them click on your site and not your competitors’. By the way, if your meta is not concise enough, Google will rewrite it as it sees fit.

- Header Tags (H1, H2, H3, etc.)

Use header tags to structure your content. This way you’re making it easier for search engines to understand the hierarchy and importance of information.

Keyword Research

One of the crucial elements of successful SEO, keyword research is something you need to do to make sure your content meets the demands of your potential customers. Insurance sphere is vast and has a lot of specific terminology, but your customers may not alway have the deep knowledge of it. Keep in mind that they may be searching for the services you offer while using the language that is very different from your industry lingo.

- Identify Target Keywords

Tools like Google Keyword Planner, Ahrefs, or SEMrush will help you to find and create your own pool of relevant keywords that potential clients are searching for. Make sure you are considering the specific terminology aspect.

- Focus on Long-tail Keywords

Long-tail keywords narrow down the search. Using them allows you to pick up very specific search requests that are highly relevant to your services. For example, “affordable car insurance for young drivers” or “best condo home insurance in Seattle.”

- Competitor Analysis

It’s always a good idea to study your competitors and pick up some of their successful practices. Analyze other insurance websites, especially those taking top SERP places for your most important keywords. This is a good way to identify keyword opportunities and gaps in your content.

Web Design

If your insurance company website boasts a good design, attracts visitors and encourages them to stay longer and engage with your content. Not just that, however, as of the latest Google Core update, the quality of user experience plays a more significant role in SEP placement.

- User Experience (UX)

Introduce a user-friendly interface with intuitive navigation, clear call-to-action buttons, and easily accessible information. Do not lead your users own, use clickbait or be vague about your services and prices.

- Visual Appeal

Make sure you have high-quality photos and that your design elements look professional. An aesthetically pleasing website will be simple, but neat, with consistent branding and no element overload.

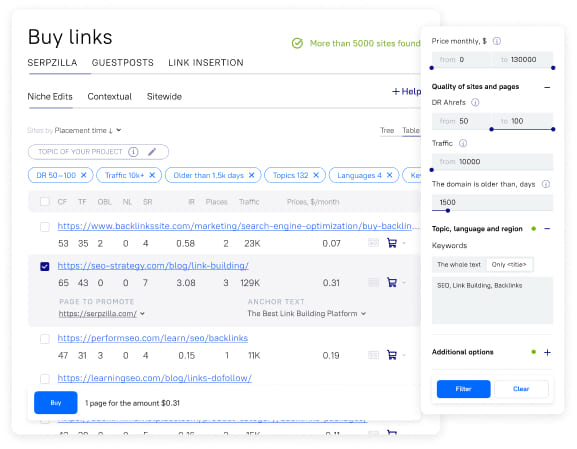

Link Building

Link building is a science in itself and we recommend you to get your homework done well in this sphere if you want to have a robust backlink profile. Some key strategies for insurance businesses are:

Write guest posts for reputable insurance industry blogs about matters that your customers see as acute and relevant. Include links back to your website and its materials.

Buy Guest Post Backlinks on Top Insurance Blogs

Secure high-quality backlinks from trusted insurance blogs accepting guest posts. Boost your SEO rankings, build authority, and drive targeted traffic to your insurance website today.

| N | URL | DR | Traffic | Action |

| 1 | https://techbullion.com/ | 78 | 141000 | Book Guest Post |

| 2 | https://www.kadvacorp.com/ | 74 | 15000 | Book Guest Post |

| 3 | https://developmentmi.com/ | 73 | 7000 | Book Guest Post |

| 4 | https://testseries.edugorilla.com/ | 72 | 199000 | Book Guest Post |

| 5 | https://realtybiznews.com/ | 72 | 11000 | Book Guest Post |

| 6 | https://calbizjournal.com/ | 70 | 18000 | Book Guest Post |

| 7 | https://leadgenapp.io/ | 68 | 28000 | Book Guest Post |

| 8 | https://www.webtechmantra.com/ | 67 | 95000 | Book Guest Post |

| 9 | https://totsfamily.com/ | 67 | 26000 | Book Guest Post |

| 10 | https://lerablog.org/ | 67 | 7000 | Book Guest Post |

| 11 | https://askcorran.com/ | 66 | 1000 | Book Guest Post |

| 12 | https://trotons.com/ | 65 | 53000 | Book Guest Post |

| 13 | https://www.ciotechoutlook.com/ | 64 | 6000 | Book Guest Post |

| 14 | https://jetfamous.com/ | 64 | 1000 | Book Guest Post |

| 15 | https://technewsenglish.com/ | 64 | 1000 | Book Guest Post |

| 16 | https://www.healthworkscollective.com/ | 64 | 21000 | Book Guest Post |

| 17 | https://thedailytribute.com/ | 64 | 1000 | Book Guest Post |

| 18 | http://www.easyfinance.com/ | 63 | 1000 | Book Guest Post |

| 19 | https://sizesworld.com/ | 63 | 5000 | Book Guest Post |

| 20 | https://www.homeinside.net/ | 63 | 1000 | Book Guest Post |

| 21 | https://ultimatestatusbar.com/ | 63 | 1000 | Book Guest Post |

| 22 | https://eagerclub.com/ | 62 | 2000 | Book Guest Post |

| 23 | https://caresclub.com/ | 62 | 1000 | Book Guest Post |

| 24 | https://tallestclub.com/ | 61 | 1000 | Book Guest Post |

| 25 | https://techcrazee.com/ | 61 | 7000 | Book Guest Post |

- Establish Partnerships

It is vital that you collaborate with industry associations, local businesses, and influencers. It will help you build your reputation as an insurance expert and also to earn coveted backlinks.

- Content Marketing

Create valuable content, such as insurance reviews, analytic articles, infographics, whitepapers, and case studies. If your observations and findings are of interest, other websites will want to link to them and your audience will also reblog and share them.

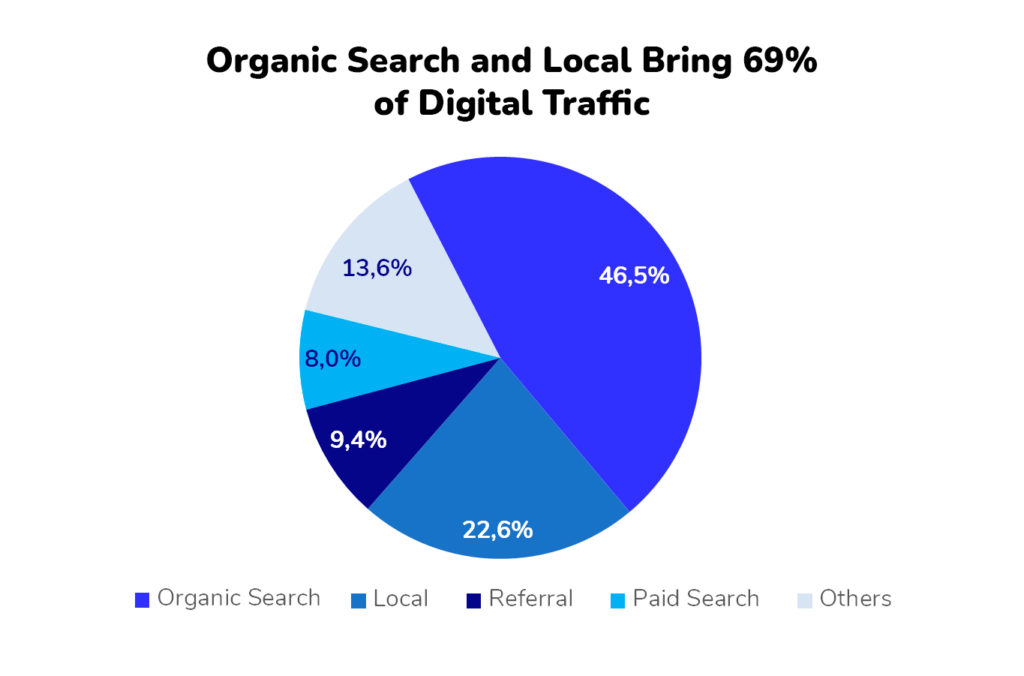

Local SEO

For insurance agencies, local SEO is very important as most insurance businesses have offline operations too.

Tactics include:

- Use Google My Business

Claim and optimize your Google My Business listing with accurate information, including your address, phone number, website, and business hours.

- Local Citations:

Getting your insurance business listed on local directories and citation sites, such as Yelp, Yellow Pages, and industry-specific directories, is a must. Yellow pages may seem outdated to you, but older people are still widely using it, and it may be one of the few ways to reach your senior customers.

- Use Local Keywords

It is important to sprinkle your content with local keywords, such as “auto insurance in [city]” or “home insurance near me.” It will allow search engines to get your website through geographical filters and show to customers around you.

Social Media

Social media presence is inevitable if you want to do well as an insurance company or individual agent on the Internet today. It is also a great way to connect with your customers, to quickly receive feedback and to follow trends in your domain. Here’s what you can do:

- Consistent Branding

When posting on social media, use consistent branding across all channels to build recognition and trust amongst your audience.

- Regularly Create Engaging Content

Share valuable and engaging content, including blog posts, industry news, tips, and client testimonials. The most important thing is to do it on the regular basis so that social media algorithms don’t remove you from suggested content.

- Engage your Community:

Actively participate in community discussions, share your views and opinions on trending topics, and respond to comments. When you engage with followers, you make them feel valued and build relationships that enhance your online presence.

Conclusion

Insurance is a domain that has many processes and rules that are specific to it. Of course, it affects how marketers promote insurance services and brands. Some strategies that work perfectly fine for another industry, will bring no result for insurance. Following these tips and best practices will help insurance companies and agents to build a solid and working SEO strategy, to avoid inflating their SEO budgets and see faster ROI for their SEO efforts.